While dealing with financial markets, one must come to hear about the Forex

market. The following essay attempts to expound on what the Forex market

actually is and delves deep into every aspect of it.

Very briefly, the Forex market is one of the world’s largest trading markets which

operates in a decentralized manner, meaning that it does not have a single

specific operating location.

Trading in a nutshell

Throughout history, people have looked for different possible ways to obtain

money and preserve its value. This quest has led to innovations which has shaped

and reshaped the economy and helped societies leap towards progress. Let’s take

for example the simple act of buying a book. While buying a book, one must pay

its price in the current currency. The act of transferring money into the market

further perpetuates the market towards more production and thus more capital.

Production and demand tend to keep the market in action and this leads to

creation of capital and creation of capital in return leads to more demand and

production. This cycle tends to hold the economy together. Now each country

tends to have its own unique currency. In order to circulate through the system,

one has to do so with the that its unique currency. Outside currencies are not

mostly accepted.

One might wonder what it takes to exchange currencies. This question laid the

groundwork for what it came to be known as currency exchange. The difference

in exchange rates in different countries attracted attention. People realized that

they would be able to make a profit from this rate difference and this was the first

cornerstone of the formation of an international market which was later called

Forex, or the foreign currency exchange market. Nowadays, one can make a profit

by dealing in buying, selling and exchanging the value of currencies of various

countries. With the growing expansion of the market and the increase if the

number of its traders, it has become possible to provide other diverse services

such as buying and selling digital and cryptocurrencies and trading on very

prominent stock indices. All in all, the Forex market is widely held popular by

different traders due to its prominent features.

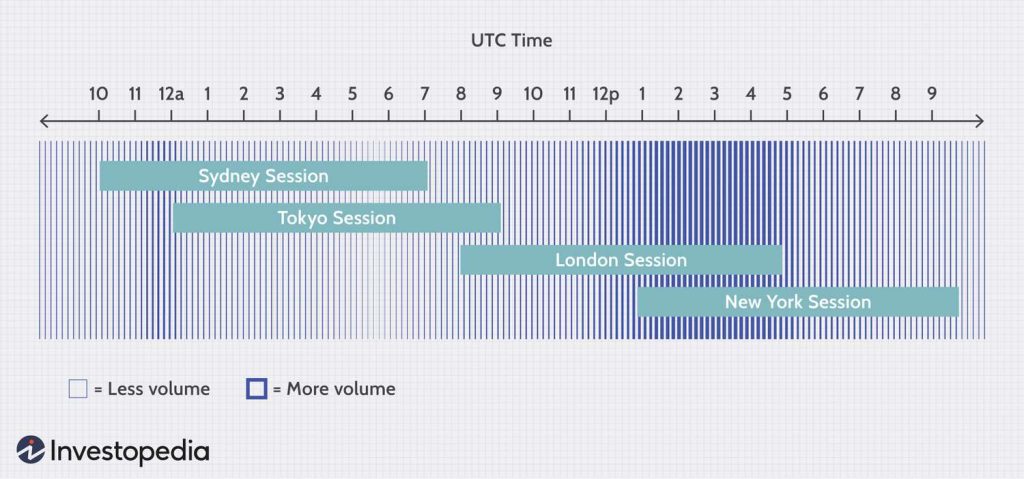

Forex working hours

one crucial piece of information any traders on the Forex market needs to have is

the working hours. The Forex market is active on a 24-hour basis for 5 days of the

week. It tends to close from Friday evening to Sunday afternoon. Among the

working hours, there are more pivotal hours in action due to the opening of

prominent markets with High liquidity volume. Some of the most important Forex

working hours are as follows:

– Tokyo market opens at 9 AM and closes at 5 PM in local time.

– London market opens at 8 AM and closes at 4 PM in local time.

– New York market opens at 8 AM and closes at 5 PM in local time.

The emergence of the Forex financial market

Due to constant shift in the use of currency and with technological advances,

currency markets advanced in a more unprecedented manner than any other

time in history. With the strengthening of the currencies that had previously

remained under the banner of political systems dependent on the government

and the formation of emerging markets in Southeast Asia that had the potential

to attract new funds and currencies, the need for the formation of a multi-

purpose currency market was felt more than ever. The forex market was originally

formed for interbank currency exchanges. The central banks od different

countries used this market as means to exchange capital. Due to different

currency sources and the exports and imports of different objects, a shift

happened in the balance of currencies and thus countries needed to convert

currencies. To carry out this conversion, they used the bank exchange market.

Gradually, this became a trend and companies such as investment and insurance

institutions also entered this market to profit from the fluctuations in the market.

The expansion of this market progressed until Forex brokers entered the arena.

By checking and estimating the capacities of this market by the forex broker, it

was found that this type of market has the ability to have small customers, so

they can also benefit from the fluctuations of this market.

How did the Forex market begin to operate initially?

Initially, the volume of transactions, which was called the lot, was equivalent

to 100,000 dollars. Understandably, this number was quite high for customers.

So Forex brokers intervened and defined lower trading volumes such as one

tenth of a lot or one percent of a lot. Although, the newly defined prices

seemed manageable, they still were large numbers for a wide variety of

customers.

Rectifying this problem required brokers to provide the customers with

customers. This system was rather similar to the system the banks use in order

to give loans. As a solution, the trading lever (leverage) was placed before the

customers by the brokers. Leverage is the use of capital to invest in a currency

by borrowing money from a broker. It has the ability to magnify wins as well as

losses. For example, an investor might buy the euro versus the U.S. dollar with

the hope that the exchange rate will rise. The trader would buy the EUR/USD at

the ask price of $1.10. Assuming the rate moved favorably, the trader would

unwind the position a few hours later by selling the same amount of EUR/USD

back to the broker using the bid price. The difference between the buy and sell

exchange rates would represent the gain (or loss) on the trade. Although the

amounts were small at first and it satisfied, it caused the brokers to suffer losses

in some cases. So brokers turned to creating margin to manage loss. When you

open your trading account, they choose its leverage. When you open your

trading account, its leverage is chosen by default by the broker according to the

type of your trading account. If you wish, you can submit a request to change the

leverage to the desired broker. For example, if you choose your leverage 1:500, it

means that 500 times leverage will be added to your money. For example, if you

choose your leverage 1:500, it means that 500 times leverage will be added to

your money. But this leverage is as attractive as it is dangerous, because if you

use the above leverages, with the slightest movement of the market in the

opposite direction of your trade, your entire capital may be lost quickly. So you

should be very careful when choosing trading leverage, based on your trading

and financial strategy.

At the inception of Forex, only the value of currencies was traded. Gradually,

with the increasing competition between brokers, the range of transactions

became wider and came to include various assets such as gold, oil, stock and

crypto. What makes Forex globally attractive is the fact that since currency

exchanges take place to each other (that is, one product is always traded against

another), one can even make profits by selling currencies. For example, if the

euro is increasing in price against the dollar, it means that the dollar is

decreasing against the euro, and in this way you can profit from both forms of

trading (buying and selling).

CFD trades in Forex

Along with the entry of different traders and the expansion of the market, a

contract for differences (CDF) was formed. Rather than conducting main

transactions, profit is earned through the changes of the values of the goods. CDF

is a type of derivative trading which allows a trader to buy and sell an asset for a

future date. It thus helps to trade in commodities, stocks, and digital currency by

predicting price ups and downs and fast market movements.

OTC Market

OTC Market or an over-the-counter market is a decentralized market in which

traders tend to trade instruments directly between two parties without the need

for a central broker. This market does not have a physical location. Rather, all

trades are done electronically. Due to the more expanding and growing forex

financial market, activities could not be carried out in a simple market format

such as an exchange or a stock exchange. Therefore, Forex acts an over-the-

counter market.

The Advantages of the forex market

The global forex market has the largest volume of transactions. With a daily

volume of over 6.6 billion dollars, this market has unique features that make it

superior to other financial markets. There are several advantages to the Forex

market:

– High volume of liquidity

– Unlike other markets, there is no queue for buying and selling in the forex

market.

– Exceptional working hours: Forex trading is done 24 hours a day without

interruption all over the world.

– Risk management: risk management is emphasized in forex trading and

rather vital for traders.

– Low cost of transactions: no need to pay additional fees for charging and

withdrawing from one’s account.

– Trading with margin: The forex market provides traders with the highest

level of margin to be able to trade even with little capital.

– Utilization of new technologies: Due to the high popularity of this market

and the huge population of users, as well as due to the wide access to the

Internet and powerful trading platforms such as Metatrader 4, this market

has attracted the attention of many retail traders. Trading platforms are

very simple and easy to use and traders can operate in this market with the

help of technical analysis of indicators and using other trading tools.

A brief guide on how to trade in the Forex market

You will be able to trade after opening an account and depositing money into

your trading account. Trading in the forex market requires steps that will be

discussed in other articles. It is rather crucial to follow the news released by the

financial markets. By considering important news that reflects information such

as the announcement of economic indicators, you will be able to better manage

your trading position.

For example, in order to trade on the EUR/USD currency pair, by checking the

economic calendar and the events of the Eurozone or the United States of

America and the fundamental analysis of these events, you will be able to

predict the future trend of this currency pair and then based on that, open a

buy or sell position. Of course, in addition to fundamental analysis, the use of

indicators and technical analysis can show market fluctuations more and

better for you.

Different kinds of trade in the Forex market

Different trading methods are one of the main attractions of the forex market,

which may appeal to people with different goals and agendas. Since every

trader has a unique trading strategy, familiarity with different trading methods

is very crucial in order to choose a certain type of investment to. Below are

mentioned the most important types of transactions in the global forex

market:

- Spot trades: In this type of transactions, the agreement to buy or sell

between the seller and the buyer is set at the moment-to-moment market

price. - Future trades: This type of transaction is done definitively, and the price

and settlement date of the transaction are determined by agreement between

the buyer and the seller. - Option trades: is a contract that gives the buyer the option to buy and sell

an asset at a specified price on or before the expiration date of the contract

(note that the buyer has the right or option to buy and sell, but does not have

the obligation to do so). - Forward trades: Forward contract is a type of future contract. Unlike

standard future contracts, this type of contract can be ordered based on date,

price and type of goods. A forward contract is a personal contract between

two trading parties that is carried out in the OTC or over-the-counter market,

while the futures contract is carried out in the stock market with a standard

volume and specific settlement dates, which can be resold in the market as

long as the time is specified in the contract.

What are the types of currency pairs in the forex market?

In the forex market literature, trading symbols are pairs of currencies that are

traded against each other. For instance, one of the most important symbols is

EUR/USD. The Euro as a base currency is traded against the US Dollar as a

counter currency. The rate written in front of the symbol is the parity rate. This

means that if you click BUY on this symbol, it means how much dollars you

have to pay to buy each euro. There are 2 kinds of

currency pairs in total:

Major currency pairs

The major currency pairs are in fact symbols that have USD on one side. These

currency pairs have allocated the largest volume of market transactions to

themselves.

- Euro to US Dollar

- GBP/USD The pound against the US dollar

- USD/CAD US dollar against Canadian dollar

- USD/CHF The US dollar against the Swiss franc

- AUD/USD Australian dollar against the US dollar

- NZD/USD New Zealand dollar against the US dollar

- USD/JPY The US dollar against the Japanese yen

Minor currency pairs

These currency pairs do not contain the US dollar and the trading volume is

much lower than the major currency pairs.

Minor currency pairs usually end in Japanese Yen or British Pound. Note that

trading volatility on Japanese Yen and British Pound is much more than other

currencies.

- EUR/GBP Euro – British pound

- EUR/JPY Euro – Japanese yen

- EUR/CHF Euro – Swiss Franc

- EUR/AUD Euro – Australian dollar

- EUR/CAD Euro – Canadian dollar

- EUR/NZD Euro – New Zealand dollar

- GBP/AUD British pound – Australian dollar

- GBP/CAD British pound – Canadian dollar

- GBP/CHF British Pound – Swiss Franc

- GBP/JPY British Pound – Japanese Yen

- AUD/CHF Australian Dollar – Swiss Franc

- AUD/NZD Australian Dollar – New Zealand Dollar

- AUD/JPY Australian Dollar – Japanese Yen

- AUD/CAD Australian dollar – Canadian dollar

- CAD/JPY Canadian Dollar – Japanese Yen

- NZD/CAD New Zealand dollar – Canadian dollar

- NZD/JPY New Zealand Dollar – Japanese Yen

- NZD/CHF New Zealand Dollar – Swiss Franc

- CHF/JPY Swiss Franc – Japanese Yen

What is Spread?

When you are looking at the price of a currency pair, two numbers are actually

displayed to you. The price is called Bid, which is the price at which you can sell

the base exchange rate. That is, if you open a Sell transaction in EUR/USD.

Your trade will be opened at the Bid price. The second price you see is Ask,

which is the currency-based purchase rate. If you want to open a BUY trade,

your trade will be opened at the price of Ask. There is a difference in number

between the Bid and Ask prices, which is called the spread. The spread is the

number that ultimately forms your broker’s profit and is the main way of

earning for brokerages. Usually, for those who open long-term trades, the

spread is not very important. But for scalpers who want to capture small

profits in the market, the spread is very important. There are two types of

spreads. First there is the fixed spread which the broker considers a fixed limit

of spread for each currency pair regardless of market conditions, and there is

the floating spread which is more common and the broker slightly increases or

decreases the spread at different times, based on market conditions.

How to enter the Forex market?

The challenge that new users face at the very beginning is how to enter the

forex market. To enter the forex market, one needs to gain an understanding

of the market and how to operate in it. More significantly, one must have

enough patience to go through the steps of learning forex. With careful

planning and basic learning and practical training, one can gain profit in the

forex market. Below are the steps to enter the forex market:

- Learning

- Choosing a broker

- Choosing the type of account

- Creating a trading account

- Platform installation

- Practice and test

- Investment

In later articles, we shall delve deeper into how to enter the Forex Market with

much more details.

Conclusion

Unlike some who consider it an emerging market, the forex market has its

roots in the past. But in recent decades, with the advancement of technology,

this market has also been improved and updated. Considering the trading

volume of this market and its size and breadth, you need to adopt your special

and unique trading system for success. Also, the presence of many players in

this field has made trading in this market more challenging that highlights the

need for learning and training in the forex market.